Pessimists have lots of questions about LendingClub, but optimists have just one: how do their loans perform during recessions? LendingClub made roughly 99.8% of all of the loan originations it’s ever made in the years since 2009, so the business as a whole hasn’t been stress-tested. And the consumer finance business is notorious for companies that grow fast for a while and then suddenly collapse when they relax credit standards.

(Capital One might be the only exception to this rule; they’ve compounded revenue at 20% since their IPO, albeit with one 50% stock price drawdown and an 85% drop during the Great Recession.)

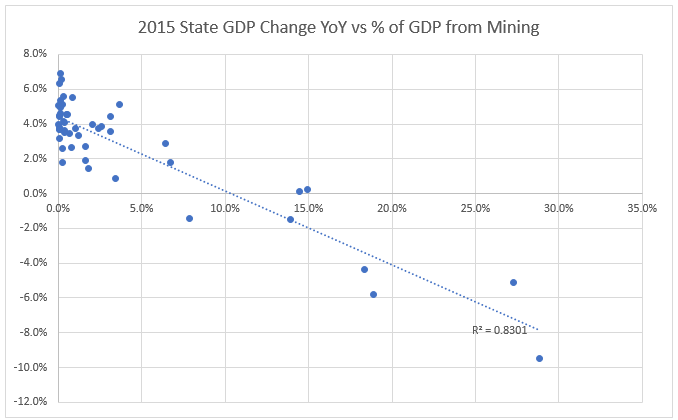

Consumer lenders need battle scars before investors really trust them. Lucky for us, the US did experience a recession recently, just not not everywhere at once. In 2015, states that were dependent on natural resource extraction experienced a large deceleration in GDP growth: of the nine states where resource extraction was more than 5% of state GDP, growth averaged -.5%; in the rest of the US, growth was +4.5%. Percentage of GDP dedicated to resource extraction predicted lower GDP growth with an r-squared of.83.

So this is a nice natural experiment. All we need to do is see how Lending Club loans fared in those regions compared to everywhere else.

Background: Understanding Lending Club Notes

Why does this matter? To understand that, you need to understand the Lending Club model, and who its investors are.

LendingClub is what used to be called a peer-to-peer lender: they match up borrowers (who need money) and savers (who have money to invest). Instead of depositing their savings with a bank, which makes loans, savers lend directly.

That was the theory back in 2006 or so. In practice, Lending Club is only peer-to-peer if your peers all run banks and credit-focused hedge funds. Roughly 70% of Lending Club’s loans in 2016 were sold directly to financial buyers, and another 15% were sold to accredited investors in Lending Club-managed funds. Lending Club makes 85% of its money from charging a vig on new loans, so their growth is almost entirely a function of how many new loans they can get. And on the margin, that’s determined by the institutional investors buying their loans.

Broadly speaking, there are two approaches to active investing: be right about one important thing, or be right about every single thing. On one end of that spectrum, if you’re a global macro investor or a venture capitalist, your career success comes down to a handful of good decisions. Equity investors are somewhere in the middle. And lenders are way at the other end: they need to know everything other market participants know, plus a little more. Lending is negatively skewed: a typical lender has a long series of pretty good years followed by one extremely bad year. And that means that excess returns in lending usually come from finding clever ways to exclude the borrowers who make those years bad years.

In Lending Club’s case, this will likely be more extreme: Lending Club loans are unsecured personal loans, so recovery rates are minimal.

So the most crucial unknown for Lending Club investors is the downside from a bad year. By looking at borrowers in natural resource-dependent states, I was able to show what a bad year looks like.

The Process

Here’s what I did:

- Lending Club gives historical data on loans they’ve made, and whether or not they were repaid. The dataset includes loan size, whether or not it defaulted, and state.

- I came up with a cohort of borrowers in 2012–14 who lived in resource extraction-intensive states (AK, WY, ND, OK, WV), and compared them to borrowers in states with little or no resource extraction GDP (DE, RI, ME, MA, NJ).

- I looked at default rates sliced by geographic cohort, loan origination date, and grade; I wanted to see if high-grade loans were stable but low-grade loans defaulted, and wanted to control for loan term. Lending Club also gives subgrades (i.e. an “A” credit might be A2 or A4), but that restricts sample size too much. I did ensure that the distribution of grades is similar for both sets of users.

Here’s what I used:

- Lending Club’s historical data.

- Python (scraping, cleaning the data, parsing out the states I wanted).

- Excel (pretty pictures).

Results

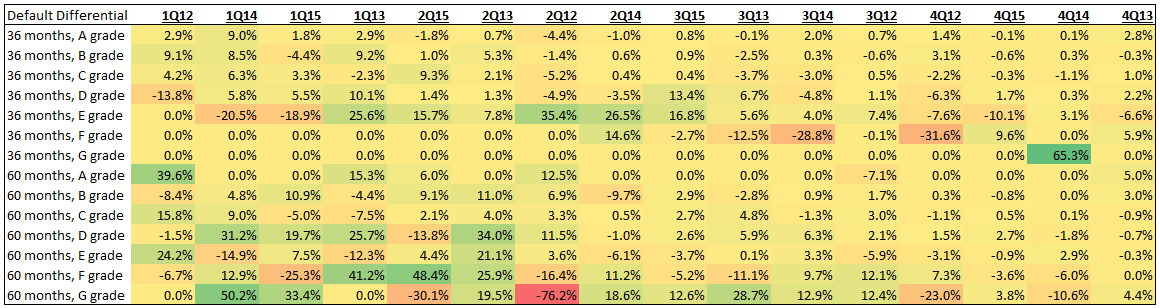

Surprisingly, the mining-state cohort actually had slightly better performance than the control group. The average quarterly default rate was lower for the mining states in all but one of the cohorts.

This is quite surprising. You’d expect to see at least some impact. My working hypothesis is that Lending Club loans can be used for consumption or for refinancing, and that the mix skews towards refinancing when the economy is weaker. Refinancing loans for a given user should get lower defaults than other kinds of loans — they’re generally structured to be paid down, whereas consumption loans are just designed to defer costs.

This isn’t a definitive test, but it’s compelling evidence: so far, Lending Club loans are surprisingly resilient to recessions.

Byrne Hobart

Byrne Hobart