Note: This is the once-per-week free edition of The Diff. Enjoy!

Coronavirus will get worse in the US for as long as policymakers model it as linear when it’s actually exponential. Of course, the infection curve won’t be exponential forever—just long enough for the disease to overwhelm hospitals, leading to hundreds of thousands of preventable deaths. Once we reach the bend in the S-curve (when 30-40% of people have been infected, and the population of recovering people is growing), the slope will slow to linear, before topping out.

Hopefully policymakers will wake up, and other institutions will act, before we get there.

There are three basic components to coronavirus policy responses:

- Slowing the rate of infection today.

- Ensuring that short-term disruptions from infections and quarantines don’t lead to avoidable long-term harm.

- Restructuring the economy to reduce the risk from events like this. The next one won’t be a disease—it might be a war, revolution, a natural disaster that temporarily wipes out a key industry, a coronal mass ejection, or something even today’s bleak pessimists haven’t thought of.

The Short Term: Keeping the Doors Open During a Lockdown

Points one and two tie closely together. The main tradeoff that drives slow response times in the US is between preventing possible deaths in the future versus causing definite economic pain today. This is not a trivial problem to consider; cost-benefit calculations apply to choices of death-versus-money, implicitly or explicitly. While a handful of people continue to claim that Coronavirus isn’t serious, they generally look at point-in-time data. I haven’t encountered an argument that the infection rate in the US will decline absent intervention. (The closest you can get is the hypothesis—hopefully true!—that infections are sensitive to weather. Not something I’d bet a lot of lives on, though.)

So the real question is: can we afford to ban social gatherings, shut down theaters, cancel flights, lock down cities, and enact other aggressive countermeasures? There’s a way to flip this around: if we find ways to mitigate the costs of these measures, they’re politically viable and will happen.

The main long-term economic harm from quarantines and lockdowns arises when companies and individuals run out of cash before they get back to work. That can set off cascading defaults, and slow down the recovery—better to furlough half the country for a month than to face 10% unemployment, mass insolvency, and a credit crunch. How can we assure this?

- One-time federally-funded vacation time—it’s important for this to be government-funded rather than funded by employers, because a few weeks of full expenses and reduced revenue can make a small business insolvent.

- A quickie force majeure process for delaying, but not cancelling, contracts. This rips the band-aid off the uncertainty we’ll face over the next two or three quarters, when different parts of the global supply chain run unpredictably short of crucial components. If a car has 100 essential parts, 1 missing part makes it worthless; we should expect work-in-progress inventory to accumulate on balance sheets while different factories come back online at different times.

- A federal program to factor—or subsidize the factoring of—receivables that have been delayed in this way. If credit is widely available, we can avoid the Minksy Moment where companies stop trusting that their suppliers can deliver.

- Create a legal safe-harbor for testing drugs, selling medical equipment, and sharing patient information. Importantly, this will lead to scammers who prey on the vulnerable. It will also accelerate the deployment of infection tracking, treatment, and hopefully a vaccine. The tradeoff here is painful, but we’ve already seen the results of restrictions on testing.

- When schools get shut down, increase EBT payments to offset the lack of subsidized lunches. (Paid vacation will offset one of the other costs—that of parents supervising kids at home.)

Basically we need an extended version of this.

All these decisions are costly, at least in dollar terms, which naturally brings up the question: how are we going to pay for this? But that’s the wrong question, or rather the wrong pronoun referent: the “this” we’re going to pay for is a pandemic that will kill countless people and disrupt everyone else’s lives. “How” we pay for it is either the affordable way, where the Fed prints money so Treasury can borrow it at 0.8% for ten years, and then spends it to counteract the massive deleveraging involved in putting the economy in hibernation—or the expensive way, where this year’s problem is a plague and next year’s problem is a rolling financial crisis.

There will be costs, and those costs will be born unevenly. An epidemic and a lockdown will cause a drop in output, so we’ll be worse-off in the aggregate. Some of us will be a lot worse off than that, but the right level on which to fix that problem is ex post, by compensating people, rather than ex ante, by not taking the appropriate action. For example, shutting down schools will be enormously inconvenient to parents, particularly poor parents. Keeping schools open will be fatal, though, so the policy goal should be to blunt this impact rather than to avoid it entirely.

Or, in economic terms: it’s impossible for every epidemic-response policy to represent a Pareto improvement over the pre-epidemic status quo. The most important question is how to reduce the social cost, by slowing down infections, and the next most important question is to fairly distribute the cost.

The Long Term: Bail Out, Diversify, Restructure

Some industries will bounce right back. Full-remote tech companies that sell software on long-term subscription models will be okay. Cruise lines won’t. It’s possible that some major industries, especially in leisure and tourism, will face sufficiently high operating costs and future restructuring costs that they won’t be able to survive. And I don’t think Norwegian Cruise can raise much equity or debt right now.

It’s possible that bailouts will be a consideration. And we can learn from the last crisis: bailouts are fraught because Americans don’t like socialism, and the ones who do really don’t like rich people. If the system is capitalism on the way up and socialism on the way down, it’s dissatisfying to everyone. So bailouts need to involve a punitively dilutive equity component. A good rule of thumb might be: if CDS markets imply an x% chance that a company goes bankrupt in the next few years, then the bailout should involve warrants giving the government at least that percentage of the upside.

(This, too, is complicated: CDS prices will also reflect the probability of a bailout. So if we enact this plan, it has to be set up in secret and then enacted all at once.)

Big countries will end up restructuring their supply chains so they’re not dependent on any one country. If the next big disaster breaks out in, say, Germany, it will be a big problem for companies that need to buy capital equipment (capital equipment, like electronics, can be maintained and refurbished rather than replaced—but swings in capital equipment spending are historically a big driver of GDP volatility, so the macro effect might be worse.

All of us—people, companies, countries, other institutions—will have to adapt to less leverage, less complexity, and more flexibility. It’s hard to measure risk-sensitivity if you don’t know what the risks are, so it’s hard for the government to impose risk-based capital requirements on non-financial institutions. This shift will have to be cultural, instead, and the cultural level we can pull is blame.

We’ll remember the CDC’s test kits, Hubei’s censorship, the executive branch’s complacency, the media’s eyerolling; we’ll all know somebody who laughed it off before getting sick. We’ll need to retain this cultural memory for a long, long time. The next disaster won’t look anything like this one at first—but by the end we’ll all realize we should have seen it coming.

Elsewhere

Tovala: Fixing Mealkit Unit Economics By Raising the Upfront Cost

I’m in Marker with a piece on Tovala, the smart oven / meal-subscription company. Dinnertime at the Hobart household begins with a perky beep from our WiFi-connected Tovala oven. In this piece, I argue that the core problem with mealkit companies is that switching costs are low; Tovala has found a way around this, by adding a chunky fixed cost that takes up counterspace, and acts as a de facto billboard right there in your kitchen. The food is also quite good.

More Coronavirus Updates

- Supply shocks are coming, in electronics, pharma, auto parts, and memory chips.

- But Foxconn says things are back to normal, both for them and for their suppliers. Shenzhen’s street traffic bears this out, with weekday traffic roughly in line with historical trends. (Weekend traffic is much lower.)

- Airbnb bookings are dropping, although reservations a few months out are looking better. Some of this may be demand being pushed back. Airbnb’s Q4 losses doubled, although revenue grew in the quarter, a challenge for their 2020 IPO plans. This sounds a bit worse than it is: revenue is more seasonal than costs, and Q4 is the slow season for lodging. You’d expect their relative performance in off quarters to look worse over time as their growth rate stabilizes. When a company is tripling in size every year, seasonality is just noise, but at a slower pace, it’s visible.

- Hotels are a good live indicator of economic activity; the swings skew towards corporate spending, which is somewhat responsive to equity markets. Revenue per available room dropped 12% Y/Yin the week ended March 9th, with San Francisco performing the worst.

Platform Peril, con’t.

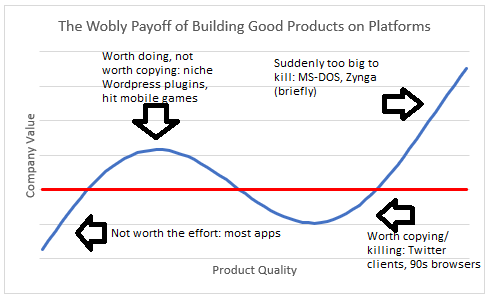

In last week’s post, I mentioned the wobbly payoff curve between product quality and economic returns when you build on someone else’s platform. If your product is too good, it’s worth copying or killing. If you’re worried it’s too good, you have no choice but to make it unkillable.

Try it in chart form:

The latest: Snowflake has earned a $12bn valuation for its cloud-based data analytics platform. Now, all the cloud companies it uses are trying to kill it. Building on a cloud platform is especially treacherous, because you inevitably give your biggest competitive threat deep insights into your customers, their use cases, and their margins.

How Dry is PE Dry Powder?

Private equity firms have $1.4tr in uninvested funds. Will they spend it?

I say no: to make an investment, PE firms need to make capital calls, i.e. their LPs have to write checks. Most of the time, this is fine, but when everyone needs cash, it’s really not. One reason PE firms didn’t buy the dip in 2008-9 is that they were chicken, but a better reason is that their investors told them not to make capital calls if they ever wanted another investment again. (LP interests in PE funds sold at steep discounts in the crisis, because when there’s a dollar shortage the last thing you want to own is an asset that requires negative cash flow.)

Pension funds have been overweight equities for years, and have increasingly invested in PE. On the way up, that was a great bull case for PE: they’d keep gathering assets. Now, pension funds have lost money on their equity positions. Meanwhile, low interest rates mean that their liabilities are bigger than ever. Essentially the pension trade was long equities/short duration. Now, equities are way down, and duration has paid off just fine. So the ever-rising PE AUM story is effectively over.

If you enjoyed this post, subscribe today.

Byrne Hobart

Byrne Hobart