This is the once-a-week free edition of The Diff, the newsletter about inflections in finance and technology. The free edition goes out to 13,927 subscribers, up 2,369 week-over-week. (Thank you, Patrick Collison!)

The Diff will be off on Monday, September 7th, for the Labor Day holiday. Back on Tuesday.

In this issue:

- Banking when you can’t Bank on Anything: Part 1

- France’s New Industrial Policy

- China Exit Subsidies

- China Chips

- Basic Income With Right-Wing Populist Characteristics

- Facebook’s Election Redistribution

- Antitrust Timing

Banking when you can’t Bank on Anything: Part 1

Most Diff readers live in fairly wealthy parts of the world, and we have the happy advantage of always thinking in a global currency. Rich countries can have currency problems, of course, but the usual form they take is a modest increase in the cost of living and a large increase in the cost of fancy vacations. Not exactly earth-shattering.

But for much of the world, currency is a lingering problem. If you earn your revenue or salary in naira, rupiah, lira, or real, there’s a reasonable risk that a currency and financial crisis could wipe out some or all of your savings, and the ensuing economic disruption could cost you your job. Since each of these countries is a small fraction of the global economy, modest capital flows from richer countries can have an outsized impact on them. And since many of these countries have to rely on exports for growth, they’re also vulnerable to drops in demand.

Countries with large and stable economies face hard decisions around currency, but smaller countries face existential ones: borrow too much in outside currency (whether at the government level, in the banking system, or directly by corporations) and a crisis can wreck the economy. But don’t borrow enough, and your country’s economy grows slowly while other nearby countries industrialize faster and leave you behind.

The Old Regime: Bretton Woods and Interesting Times

I’ve written before about the Bretton Woods system, in which most currencies were pegged to the dollar and the dollar was pegged to gold. This system led to a period of financial history that was boring on the surface and exciting underneath: it made goods mobile (because no one had to worry about exchange rates) but made capital stay put, leading to fewer booms and busts, but maintaining the system required constant, elaborate policy efforts. US attempts to maintain currency stability played a role in Britain’s withdrawal from Suez, the US’s mix of ground forces and nuclear weapons in Germany, and the collapse of the textile industry in the South (and the South’s flip from Democratic to Republican).

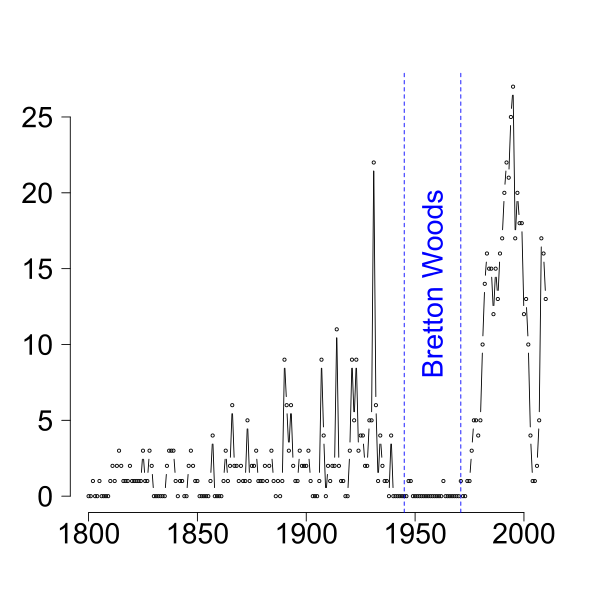

While it contributed to political instability, it created financial stability, at least on the surface. Here’s a chart of banking crises by year:

But that elides the fact that the entire Bretton Woods era comprised a pair of long, drawn-out currency crises for the dollar and the pound. Both were overvalued by the scheme, and got more overvalued the longer the situation remained unresolved.[1] If you’re building a taxonomy of financial mistakes in history, you can divide them into the ones driven by hubris and the ones caused by mistakes. Conveniently, the Bretton Woods period has both.

The British pound was overvalued due to hubris: after the war, Britain had borrowed substantial sums, and had lost significant human and material capital fighting the war. But they insisted on setting a high value on the pound, which made it hard for Britain to recover economically after the war. They had one advantage: Commonwealth countries kept much of their financial reserves in pounds, so Britain had a natural buyer for its currency. But sometimes, that was conditional. Singapore kept its reserves in pounds to encourage the British to keep defending them, and diversified by discreetly buying gold smuggled from South Africa.[2] Britain periodically ran short of reserves and had to get bailed out, or devalue their currency, and each devaluation made other countries less enthusiastic about holding pounds.

The US was not exactly hubristic when the Bretton Woods agreements were put in place. The US dollar was the center of the financial universe, but the US was also the center of the global economy. The US alone represented 40% of global GDP in 1960, and a larger share of manufacturing output. The dollar made sense as the world’s default currency because so much of the world’s economy already consisted of exchanges between dollar owners. But as Robert Triffin pointed out in the 1960s, whenever there’s a reserve currency, other countries will demand that currency for their own reserves, so reserve currency issuers run chronic trade deficits. Since the dollar’s value with respect to other currencies was fixed, and its value with respect to gold was also fixed, the additional dollars weren’t fully backed by gold. Every year, exporters would accumulate more dollars—more claims on gold—even though the US wasn’t increasing its gold holdings. Eventually, they started exchanging dollars for gold, the US realized the peg was untenable, and Nixon suspended convertibility between dollars and gold in 1971.[3]

In short order, most currencies became floating currencies, to one extent or another. This replaced one long crisis among the two highest-circulation currencies with a series of intermittent crises among every other currency.

One of the biggest spates of crises occurred in 1997-98, among the growing economies of East Asia. The template was similar for each:

- Most of these countries let their currency fluctuate in a range around the dollar. This was more flexible than a direct currency peg, but had some of the advantages: an outside investor who invested in a stock denominated in Thai baht or Indonesian rupiah didn’t have to worry much about currency fluctuations. More importantly, a company operating in one of those markets could borrow in dollars or yen and not worry too seriously about repaying on less friendly terms.

- Borrowing in the local currency is expensive, because very few outside investors have an intrinsic desire to earn interest denominated in baht. Borrowing in other currencies is cheaper, because there are many, many investors looking for a return on their dollars and yen, and Japan in particular had exhausted many of its domestic investment opportunities.

- These loans overstimulate some part of the economy. In Thailand, they helped property speculation; in Indonesia, they subsidized loans from state-influenced banks to friends of the ruling family; in Korea, they paid for a breakneck pace of growth (Korean spending on manufacturing plants and equipment rose almost 40% annually from 1994 to 1996.)[4]

- Some outside catalyst convinces investors to call in their loans and sell the currency. Both of these are self-reinforcing. When credit is less available, economic activity slows, and other lenders start to worry about credit and call in their loans. When speculators bet against a pegged currency, the government has to buy the currency to support its value, which cuts into their reserves. If the selling power of traders exceeds the buying power of the bank, the peg breaks, and the only choice the government can make is how much currency to buy from short-sellers at an inflated valuation.

For most of the countries that went through difficulty during the East Asia crisis, the proximate cause was—the previous country to have a crisis. In every crisis, the currency got devalued and lenders got burned, which a) meant that a post-crisis country had more competitive exports, and b) meant that lenders were once again reviewing their loan book to see where else they had risky exposure.

Most of the countries that went through a crisis got assistance from the IMF, whose express purpose is to lend money to countries going through a crisis in order to get them out of it. IMF rescue packages have an unfortunate kind of game theory:

- As the rescue package gets bigger, there are complaints, both from bureaucrats and from voters. The IMF has rules about how big a rescue can be relative to a country’s size, but as markets have gotten bigger and more financialized, the size of investment flows has grown much faster than GDP.

- The smaller a rescue package is, the more likely it is to temporarily slow the crisis without solving it. A smaller package means that more lenders get 100 cents on the dollar before the money runs out again and loans start defaulting, or that the currency stays overpriced a bit longer before dropping.

- Most of the countries that needed bailouts were either a) politically dysfunctional, or b) perfectly functional, but economically adversarial. Indonesia was full of banks that were insolvent because of bad loans; Korea’s financial regulators were reluctant to admit the full scope of their problems because it meant admitting how much the country had subsidized its exports by lending to manufacturers.

So the game in a bailout is to guess the size of some number $X, where the higher your guess is, the less likely you are to actually effect a transfer, and where the smaller your guess is, the more likely that transfer goes to risk-seeking banks and currency traders instead of its intended recipients. Negative economic surprises reduce liquidity directly (because they show that the world was less certain than most people thought), and indirectly by slowing the spread of information: analysts are busy evaluating the assets they already own, and have less time to look at something new.

Headlines tend to focus on the currency trading side, because there are more personalities involved. George Soros and Julian Robertson wagered big, and had large wins and losses, betting on East Asian currencies. But in terms of size and impact, the biggest of the hot money investors were actually Japanese banks lending to these countries, not New York hedge funds speculating on them. And some headlines miss the point entirely. There were a number of articles last December talking about how the market responds to impeachment, and noting that Bill Clinton’s was associated with poor performance for US equities. Many of these articles skipped over the rather important point that Clinton’s impeachment coincided with Russia, a nuclear power, unilaterally defaulting on its debt.

After all the excitement of 1997 and 1998, there was a gradual period of increasingly sane behavior on the part of emerging market policymakers and investors. Most countries figured out that a currency peg would eventually be destabilizing, and that it was only possible with ludicrous levels of reserves. So they gave up on tight currency pegs. China figured that out, too, and went ahead and accumulated ludicrous reserves. In a way, the 90s taught policymakers the same lesson the 70s did: controlling a currency is harder than it looks. The benefits are visible from day one, but the costs keep accumulating invisibly, until they’re impossible to avoid.

This is part 1 of a two-part series. Next week, I’ll cover what’s changed since 2008, and what might change next.

[1] A currency that pegged at too high a rate tends to get more overvalued over time: exports priced in that currency are more expensive, so it cuts into the country’s manufacturing base; imports are cheap, so it encourages consumers to buy more goods and borrow more money. Both of those forces make the fair value of the currency lower over time.

[2] This sounds like a wild rumor from a shady part of the Internet, but actually comes from the official history of their sovereign wealth fund:

Dr Goh, accompanied by Ngiam, met the South African Minister for Finance, Dr Nicolaas Diederichs. Dr Diederichs was a cautious man. He turned up the volume of the television in his hotel room to prevent his conversation with Dr Goh from being eavesdropped by some intelligence agency… Dr Diederichs then fished out a US dollar note from his wallet, tore it in two and gave one half to Ngiam. The other half, he told his Singaporean visitors, would be held by his representative at the Zurich meeting. The two emissaries would verify each other’s identity by matching the two pieces.

[3] What he said at the time was “I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets…” Bretton Woods lasted from 1945 to 1971, or 26 years. The temporary alternative has been in place for about twice as long now.

[4] The fact that these countries had a state-directed model that sometimes pushed loans into politically favorable but economically dubious projects is an important part of the story. All of these governments were less democratic than the US or Western Europe. The normal way to think about democracy is that it’s how the people confer legitimacy on a government, but another way to think about it is that governments exist first (somebody has to write the rules about who votes for whom), and the democratic process is how governments make themselves legitimate. It’s not the only way. In Indonesia, the government legitimized itself by giving supporters access to loans, lucrative import rights, and a money-printing monopoly on clove cigarettes. South Korea’s industrial planners helped grow the chaebol conglomerates, but the chaebol eventually got powerful enough to demand support rather than requesting it.

A Word From Our Sponsors

Here’s a dirty secret: part of equity research consists of being one of the world’s best-paid data-entry professionals. It’s a pain—and a rite of passage—to build a financial model by painstakingly transcribing information from 10-Qs, 10-Ks, presentations, and transcripts. Or, at least, it was: Daloopa uses machine learning and human validation to automatically parse financial statements and other disclosures, creating a continuously-updated, detailed, and accurate model.

If you’ve ever fired up Excel at 8pm and realized you’ll be doing ctrl-c alt-tab alt-e-es-v until well past midnight, you owe it to yourself to check this out.

Elsewhere

I joined Josh Brown of Ritholtz Wealth Management on a podcast to talk about the “RIP FANMG” series, in which Andrew Walker and I speculated on what could kill each of the top tech stocks.

France’s New Industrial Policy

France has unveiled a €100 billion stimulus plan to help its economy recover from Covid-19, and 7% of it involves supporting local Internet companies. France has excellent technical schools but a limited VC ecosystem, so French founders often end up starting their company in France but growing it in the US. (This is a microcosm of what used to happen within the US: Max Levchin started a few companies in Illinois before co-founding Paypal in Silicon Valley.)

It’s an interesting approach to economic stimulus. Supporting startups isn’t a traditional way to stimulate economic growth, since tech companies' employees don’t have a high propensity to spend their earnings, and the positive spillover effects of startups take a long time to show up. But this model does have a major advantage. Since the French government is investing in startups, if the plan works they will have gains on their investments, which will put less fiscal pressure on them later. Most countries' policy response to Covid-19 has involved stopgap measures and temporary expedients—which is appropriate for a crisis!—but France seems to be asking which policy will put them in the best position a decade from now.

China Exit Subsidies

Japan’s government is topping up its program that subsidizes companies for moving supply chains out of China ($, Nikkei). The amount seems nominal, at just $221m, but it’s cleverly targeted: “Manufacturers can receive subsidies for feasibility studies and pilot programs.” In other words, Japan is trying to cut the cost of considering a supply-chain shift to zero. Since capital in Japan is also cheap (and since financial institutions there are still responsive to the government’s priorities), this is a high-leverage way for the government to encourage supply chain restructuring.

Meanwhile, Narendra Modi calls for supply chains based on trust and stability, not just upfront cost ($, Nikkei). India has a complicated challenge, because the government’s internal rhetoric is all about self-reliance, while its external rhetoric is more of an opportunistic call for multinationals to relocate production from China to India.

China Chips

China, of course, is not standing still. The next Five Year Plan in October is expected to emphasize domestic chip production. China has been investing in its local chip industry for over a decade, and remains far behind Taiwan, Korea, and the US in chip fabrication. But the gap has narrowed over time, and one place it’s narrowing fastest is the availability of capital. One interesting side effect of this is that historically, there’s been a global supply chain in semiconductor manufacturing, but China is increasingly pushing a world where there are two supply chains, one China-aligned and one not. Since the chip production process is so complex and specialized, this doesn’t mean full autarky, but it does mean that China needs to buy more semiconductor capital equipment. This is not unambiguously good for the semicap companies—it gives them a new source of demand, but it also puts them right in the middle of US/China trade disputes.

Basic Income With Right-Wing Populist Characteristics

Brazil has combined one of the world’s least effective public health responses to Covid-19 with a top-tier economic response: like the US, Brazil has offered poor workers such high direct cash transfers that poverty has declined despite a serious recession, but unlike the US, Brazil is not a country with the fiscal flexibility that makes such decisions obvious.

Facebook’s Election Redistribution

Facebook has announced a ban on political ads in the week before the Presidential election. Politics is graded on a curve, so this isn’t an unambiguous giveaway to either side. In general, it has the same kind of effect as campaign spending restrictions: it benefits anyone who is good at organic media, and harms anyone who’s better at paid media. In this case, “good” is tricky; Trump is great at ensuring that he dominates news coverage, but not especially good at ensuring that it’s for a positive reason. And since Facebook still offers pages some organic reach, this doesn’t cut into their revenue so much as it redistributes it: the goal of each campaign’s Facebook marketing is now to maximize their organic reach in the last week of the campaign, instead of maximizing paid and organic reach throughout.

Antitrust Timing

There’s a broad political consensus in favor of antitrust action against Google, and a fierce partisan debate over whether it should start just before the election or just after. At one level, this is politicizing what should be a legal/administrative procedure, but at another level the process is intrinsically political: the subtext of antitrust actions is not just that big companies can harm consumers, but that bigness as such is suspect, and that governments should target companies based on size first and figure out exactly what they did wrong later.

Ironically, the best outcome for Google is that they get hit with half-baked antitrust action sooner rather than a well-developed case in a few months. Not only do they get their problems out of the way, but those problems aren’t as dire.