Plaid: Data Layer to Payments Layer?

At the beginning of 2020, Visa announced plans to acquire fintech company Plaid for $5.3bn. The deal was about connectivity: Plaid lets other fintech companies link their products to customers' bank accounts; at the time of the deal, Plaid interacted with 25% of all US bank account holders, and had accounts growing 115% annualized. (Their most recent disclosure was 40% penetration of US bank account holders.) Visa's guidance indicated that Plaid would add about 90 points to revenue for the fiscal year ending September 2021, implying that Visa was bidding 25x sales for a company that, while impressive, was also well on its way to saturating its core market.

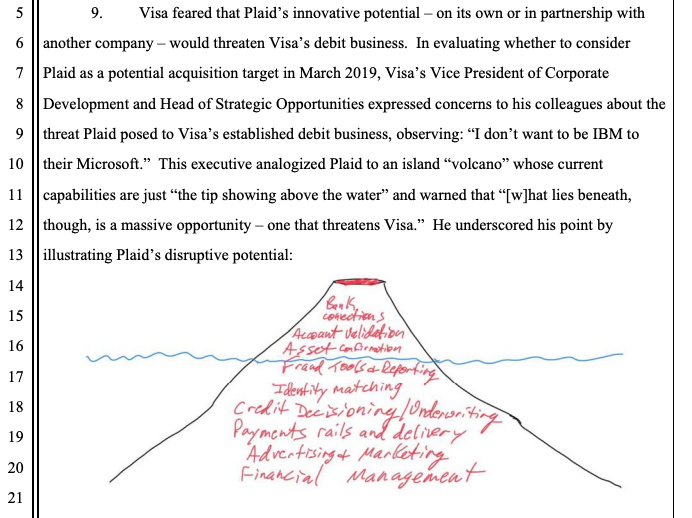

Visa had some other plans for Plaid, which were revealed in a wonderful way (if you're an outside observer) or a terrible one (if you're a Visa shareholder or executive). Since Plaid had access to so many bank accounts, it had the infrastructure for account-to-account transactions using cheap ACH payments. Here's a relevant doodle:

As the formatting may indicate, this is from a legal complaint attacking the deal as anti-competitive: Visa wasn't paying $5.3bn for a niche company that made the signup process easier at banks, but for a company that has essentially created the necessary infrastructure to build a payment product that got around Visa—and that had, incidentally, found a negative-CAC way to sign up customers, since Plaid's account access comes from a paid product.

Perhaps not coincidentally, the company raised at a $13bn valuation, up 141% from the Visa offer, in April 2021.

There are a few high-level stylized facts that drive the economics of payments:

- A given transaction theoretically involves at least four active parties: customer, merchant, customer's bank, and merchant's bank.

- Banking, particularly in the US, is a very fragmented industry (there are 6,000 banks in the EU and 11,000+ banks and credit unions in the US ). So the hit rate for the customer and merchant sharing either the same bank or sharing banks that have an active relationship is low.

- This creates demand for network effect-driven intermediaries, whether they're government-mandated (like the Fed, whose most impactful function early on was clearing checks at a consistent 100 cents on the dollar) or in the private sector (Visa, Mastercard).

- Payments and credit exist on a continuum; even a simple cash transaction isn't truly settled if the customer might demand a refund, and other payments have a lag between when goods change hands and when money does. (This lag can move in the other direction: pay for a plane ticket and the airline is borrowing a flight from you, to be paid back at a later date.

Plaid is increasingly putting itself in a position where it could function as one of these networks. What the company offers is a service to connect bank accounts to other fintech products. For example, a month ago I was looking for a mortgage, which meant filling out lots of forms and eventually giving lenders some inkling of whether or not any of the fields on the forms were accurate.1 One source of those inklings was giving them access to my bank data by way of Plaid. Other use cases include connecting to automated investing products, or linking business bank accounts to payroll services.

Plaid's system for doing this is a little bit hacky, and "hacky" combined with "access to lots of money" is never a good sign: Plaid presents users with a signup page that includes their bank's logo, and asks them to sign in with their bank username and password, after which Plaid links accounts on the backend. This "linking" takes the form of screen-scraping—Plaid is logging in as the user, scraping transaction data, and potentially performing actions on the user's behalf. This hackiness is entirely a reflection of the fact that banks aren’t optimizing for this kind of use case, and Plaid is working around the deficiency. (As Paul Graham pointed out a long time ago, a “hack” has two different senses—it’s either an ugly, quick solution or a clever, quick solution. Plaid fits both of these.)

Solving this problem on a one-off basis for accessing a single bank is, potentially, doable for any software company that needs to connect to a bank account, but solving it for the long tail of financial institutions is a colossal pain; banks have inconsistent user interfaces, and small ones don't have big IT budgets. (There's probably a U-shaped difficulty level here, where the biggest banks are a low-cost investment because they have so many customers, the smallest probably use similar off-the-shelf software, and it's the mid-sized banks that will a) build something on their own, and b) build it not especially well.) Plaid makes money from signups and usage (per this Stratechery piece ($), more money from usage than from signups).

A business that integrates a messy system into a consistent API will tend to have a pretty organic sales cycle: customers might do their first few integrations in-house, but as a they scale the need to add additional integrations gets more and more annoying; you probably won't get very far Googling questions like "what's the easiest way to scrape user transactions for Carrollton Bank," or whoever but if you look around for thoughts on solving the general case, you end up looking at a service like Plaid.

In a Tegus interview, a former Plaid executive cites the extreme distribution:

in the U.S., over 10,000 different institutions. And remember, when I first ran Plaid, with support, I had hired 8 institutions and 8 got us to about 80% of coverage. But what we learned [is] that developers really want one point of integration with which they could have 100% coverage.

Getting a problem to 99.x% solved has variable pricing power, but getting it to 100% solved has much more consistent and higher pricing power.

This would obviously be much easier if every bank used an API, and if they all used consistent APIs. But would it be better? One advantage of the screen-scraping approach is that it gives Plaid the power to do whatever bank customers can do, rather than just whatever the API allows them to do. And since most banks care more about their customers than about third-party software developers, it's likely to be more reliable, more frequently-updated, and more full-featured than an API would be. If a bank doesn't want to enable third-party platforms to compete with it, it might limit the API, but as long as the building blocks for that competition exist as actions a single user can take, it's possible to reimplement them on a higher-level platform.

One such product is a bank-to-bank payment system using ACH, where Plaid would play the Visa/Mastercard-like role of intermediating between financial counterparties. This is very interesting as a theoretical possibility, and got a bit less theoretical late last year ($, WSJ).

ACH is much cheaper than credit cards, but it's also slower. But a slow and very cheap payment can be transformed into an instantaneous and competitively-priced one by an intermediary willing to take credit risk.2 As above, 100% has more pricing power than 99.x%—if the transaction can reach parity with debit or credit cards for both sides, and has a lower price point, it's competitive. High penetration among bank accounts actually de-risks ACH-based payments for Plaid in two ways:

- They can look at prior and recent spending patterns to see if someone's other spending is suspicious, and their dataset for this kind of spending will be larger than that of any single bank, and

- They see both the transaction leaving and when it hits the recipient’s account.

The long-term thesis that Plaid could become a serious payments player bears an interesting similarity to Carta's ($): Carta built a fairly boring back-office product that helped companies keep track of their cap tables, instead of reconciling various Excel docs and sending lots of emails back and forth. But this boring product, after a few years, gave them a competitive advantage in the very exciting business of arranging transactions in private companies' shares. Since Carta knows the cap tables, and since the early investors all know Carta, it has a head start in getting the deal.

One serious drawback is that merchant acquisition is difficult and user acquisition is more of a statistical than binary construct. Plaid works with 40% of bank account holders in the US, but most of them are not aware of this (you can see if you're a customer here), and none of them think of Plaid as a payments option. When Visa talked up Plaid's potential, it listed four ways the acquisition would help them, with payments as a subset of just one of these. And that's with the help of Visa, one of the most recognizable financial brands on earth. The standard interface for these kinds of payments also leaves a lot to be desired: if retailers are saving 100 basis points in fees and losing 5% of customers to a clunky payment process, they'll give up fast. (As the post notes later, the process can be implemented in non-clunky ways—but only with tighter integration from merchants.)

Plaid ends up being a sort of ominous participant in the fintech ecosystem. They're in the enviable position that high-growth companies depend on them for something mission critical, and give them usage-based payments for it—so their default dollar retention is high; their existing customers are (ideally) gaining share in markets while Plaid adds new customers in those markets. And as they grow and come to saturate one market, they're in a better and better position to do something extremely disruptive in payments instead. In Visa's acquisition presentation, Plaid's addressable market is $3.2bn, so they're four doublings away from saturating it (and that market has probably grown, as the number of fintech companies keeps rising). In a many-sided network problem, getting a competitive advantage in working with one hard-to-reach set of the network, especially one that deals with a big and profitable duopoly, creates a temptation to make things more competitive again.

Thanks to Diff reader Andy Lam for suggesting Plaid as a topic. And disclosure: I have a financial relationship with Tegus.

A Word From Our Sponsors

RIP Robo-Advisors

Repeat after me “I’m better than a robo-advisor.”

You don’t read the Diff every week to let a robot manage your money, do you?

But picking stocks is a risky-game: ~30% of all stocks are down 40% or worse from 52 week highs.

Woof.

So how do you invest your money in 2022 to take advantage of market turmoil? You set up rules-based investing to capitalize on volatility.

With Composer, you can set up systematic-trading strategies in a snap with their no-code portfolio visualizer.

You can edit their “Buy the Dips Nasdaq ” template and customize it to only buy the top ten holdings if they were up over 30% last quarter and rebalance every two weeks. Pretty neat, right?

Your traditional Robo would short circuit with those instructions.

With Composer you can drag, drop and quickly backtest strategies from their library or your own - no code, messy spreadsheets or Terminal required. And it's 100% free.

Don't wait, Diff Subscribers get priority access to Composer with this unique signup link.

Investing in securities involves risks, including the risk of loss. Borrowing on margin can add to these risks. Composer Technologies Inc., SEC Registered RIA.

Elsewhere

The Next Conflicts

In the developing world, one of the key functions of government is to subsidize food and fuel. Fuel subsidies are bad for the environment ($, Economist), but cutting them has consequences. More expensive food, without subsidy offsets, has been blamed for the Arab Spring (though there's some debate on this).

So it's worth noting that the world's #1 wheat exporter invaded the world's #6 wheat exporter, leading to sanctions on the world's #1 natural gas exporter. Despite EU natural gas prices that are currently close to their December record, the EU plans to subsidize gas storage over the rest of this year ($, FT). And natural gas accounts for up to 85% of the cost of ammonia, an input into fertilizer costs ($, WSJ). It's easy to focus on just one international issue at a time, but when a problem affects a big exporter (or two big exporters), it can be quite contagious. This list of countries by how much consumer expenditure goes to food is a useful one.

Decentralization as a Liability

Crypto protocols have no concept of countries, laws, or monetary value, which is a great strength for them since it means there are fewer limits to what can be built on them, but which is also a great weakness because a) they need intermediaries to connect them to anything in the real world, and b) those intermediaries do understand such concepts, and have to respond to them. The latest example of this is that Metamask banned Venezuelan users while OpenSea has blocked some Iranian users. There is no direct way to stop someone from using crypto to get around sanctions—but there are many ways for the intermediaries who interact with crypto to enact these bans, some clumsier than others. For the intermediaries, there are two categories of asymmetric risk:

- Most economic activity, and most crypto activity, does not occur in places that are currently under sanctions or running that risk. So banning a tiny amount of activity to avoid legal risks to the vast majority of what happens on the platforms is a good deal financially. On the other hand

- The most avid crypto users care very deeply about decentralization, and tend to get quite upset when crypto companies don't live up to purist crypto ideals.

Company policies have to be a balance between points 1 and 2 (and point 2 is especially acute because one population with lots of crypto purists is the people working at crypto companies). But stricter sanctions, especially politically popular ones, tilt the balance in favor of point #1. This is deeply unfair to bystanders, but sanctions are all about inflicting harm on both sides and maximizing the harm to one of them.

Decentralization as an Asset

Crypto is not just a route around retaliatory sanctions; it's also a way to get money to Ukraine, perhaps in order to fund more direct ways to punish Russia ($, WSJ). Crypto infrastructure is resilient since the network is globally restricted and interaction with it just requires an Internet connection. There's a perennial crypto-skeptic debate about this: if the world ends, are you really going to keep running that Bitcoin full node? But it turns out to work reasonably well in cases where daily life in a country has been severely disrupted, but Internet access is still possible. This ends up being a counterpoint to another issue raised by Ukraine—that global supply chains have local dependencies, making them brittle in the face of real-world changes. As it turns out, some aspects of globalization, like the ability to rapidly transfer money to arbitrary recipients around the world, are surprisingly durable, and often come in handy.

Reopening

Google and Twitter have announced that their offices are reopening, with Google requiring some employees to work in the office three days a week and Twitter retaining its commitment to remote work forever while strongly hinting that employees ought to work out of the office. It will take time to figure out the right equilibrium for hybrid remote work once it's mandated (in general, everyone wants the option to work from home but they'd prefer that when they're in the office, the people they want to work with are, too). Since many smaller companies have gone fully remote and aren't adjusting compensation based on costs of living, these companies are indicating that they see significant value from in-person work. Some of that is from higher-bandwidth communication, some is from social pressure (it's harder to be half-focused on work when you're at the office and incredibly easy to do it at home), and some is probably about retention—if you get most of your socialization at the office, then quitting means losing friends, too. This thinking helps explain why free dinner at the office is one of the highest-ROI investments any big company makes, and probably explains some of why they want workers back at physical offices, too.

Succession Problems

Relevant to the 10,000-year endowment question: UAE is revising inheritance laws to stop family-run conglomerates from breaking up when their owners die ($, FT). Even though these businesses aren't especially efficient, there's a cost to letting them die from infighting and litigation rather than from competition. The result of that kind of change can be a lot of friction and inefficiency, after which the assets and employees just end up in another inefficient family conglomerate.

Diff Jobs

Interesting new roles from companies in the Diff network—if you'd like to hear more about these (or want to know what other roles people in the network are looking for), please reach out.

- A company in the alternative data space is looking for equity researchers. (US, remote)

- A company building a wildly ambitious decentralized communication tool is looking for someone to do FP&A. (US, remote)

- An eCommerce company building tools for medium sized creators is looking for product designers and product marketers. (US, remote)

- A company in the edtech space is looking for an engineering manager. (US, remote)

- A company which helps platforms offer working capital loans to their merchants is looking for people across the company including (but not limited to) data science, software engineering, product marketing, and customer success. (SF, in person)

As a general principle, filling out forms, particularly repetitive ones, is a tax on human effort that's just big enough to be seriously annoying in the aggregate while being small enough that it doesn't inordinately frustrate anyone enough to fix it. The people who face a personally high opportunity cost from transcribing the same information into lots of other forms are generally in a position to pay someone to do their various form-related tasks. But as a wise commenter once pointed out (TK Beiser tweet), this is a big expense in the aggregate.

One way metasearch companies, compatibility layers, etc. create value is by reducing this form-related friction. Which also means they're all in indirect competition with browser- and OS-level autocomplete. The value these metasearch and compatibility products have is an interesting proxy for just how valuable autocomplete is as a Chrome feature—Google monetizes incremental Internet usage, and especially incremental commerce, through ads, and some companies whose core value-add is eliminating the need for filling out repetitive forms are worth billions of dollars. So it's possible that autocomplete creates tens of billions of dollars or more in value for users, an increasing share of which Google will capture over time. ↩

This is roughly what your broker is doing when you sell one stock and immediately roll the proceeds into another: the transaction won't settle for two days, but your broker is willing to spot you the cash in the meantime. You can think of their commissions, or in the case of Robinhood their payment for order flow, as partly an interest rate charged on this small credit transaction. ↩