Welcome back to The Diff. Here are the subscribers-only posts you missed this week:

- When and Why to Love Nonvoting Stock covers the game theory of founder/CEO control: when investors back a CEO who makes contrarian decisions, they expect other investors not to be wise enough to go along.

- TikTok and the New Old Normal: The TikTok deal is very strange, by US standards—but the US is an untested outlier, and digital protectionism is common in the rest of the world.

- Recursive R(t): Covid-19 is novel for being a pandemic active in multiple countries and a major media event. This makes infection rates partly a function of recent trends in reported infection rates.

- China Skepticism: Bipartisan and Multilateral: During a Presidential campaign, each side stakes out issues it has an advantage in campaigning on, which exaggerates differences. But there’s long been a portion of the US electorate with negative views of China, so US/China conflict is more bipartisan than it seems.

Support The Diff and subscribe now!

This week’s Q&A will be today at 2pm Eastern/11am Pacific. This week, the call will be open to all readers, not just paying subscribers. Topics include shareholder votes, TikTok and Tech Nationalism, Covid, S-Curves, and more.

This is the once-a-week free edition of The Diff, the newsletter about inflections in finance and technology. The free edition goes out to 15,163 subscribers, up 298 week-over-week.

In this issue:

- Surfing the Right S-Curve

- Google: Benefits and Retention

- Tail Risk on Trial

- Policy Homogeneity

- Procurement

- Density Redistribution

- Crisis Hormesis

- The Other Derivatives Narrative

Surfing the Right S-Curve

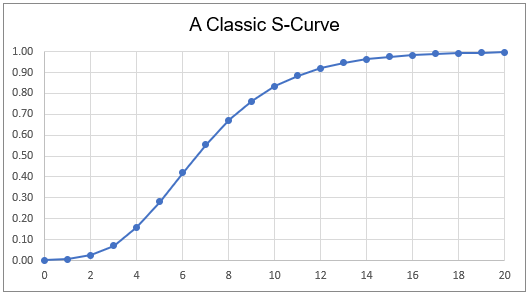

Take anything that’s subject to selection pressure, and track how it grows in a new environment over time. You’ll get a graph like this:

It starts out small, adapts to the environment, grows a lot, and peaks when it’s perfectly optimized for its current environment.

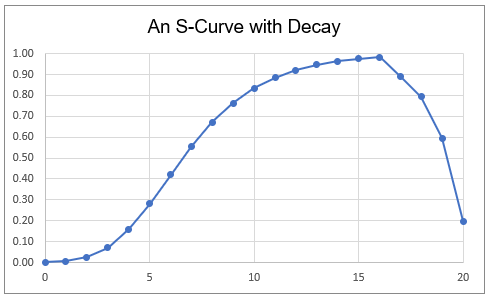

Usually, if you wait long enough, you get a graph like this:

That’s a graph of something that’s gotten good at exploiting all of the inputs it needs, and either a) it accidentally depletes one of those inputs, b) the mix of inputs changes, or c) the phenomenon in question turns out to be a good input for some other phenomenon adapted to defeating it. i.e. It becomes part of the “environment” for something else that quickly turns it into a source of growth.

That curve is deliberately vague, because it can describe so many things:

- A species that gets introduced to a new environment.

- A slang term or a mental model that gets propagated in some social group.

- A career.

- A human population.

- A political movement.

- A new technology.

- A company.

The label of the Y-axis varies: biomass, Google Ngram share, salary, population, votes, unit sales, market value. The threats vary, too: a novel pathogen, a change in fashion, skill obsolescence, internal frictions, newer technology, or stagnation.

Some of these phenomena are fundamentally mindless: a colony of bacteria doesn’t wonder what it will do when it reaches the edge of the petri dish and starts running low on agar. Members of a political movement think, but the movement itself is dumber; it can easily peter out when the people who are incentivized to join are low-status and the ones tempted to leave are high-status (or if it takes power and its policies are disastrous).[1] Any given technology doesn’t have a will of its own, although it sometimes looks that way in the short term. You can anthropomorphize them the same way you can say a given gene “wants” to spread as far as possible; it’s a thing without a will, but selection effects mean it acts the way a willful thing would act, in the short term.

But for others, there’s intelligence and planning at work. The curve is not a constant. Some people look at where their career is going and see that they’re approaching a dead end. And companies, especially, thrive when they identify the S-curve they’re on and choose which one they’d like to be on instead. Many people reach a point in their work where the S-curve inflects: every project they finish gets them skills and referrals that they can apply to doing an even better project after. That’s an enjoyable situation, at least while it lasts, but empirically it doesn’t. Wage growth is fastest at the start of a career, and slows monotonically throughout—one study has real wages rising 3.3% annually from ages 25 to 34, but actually dropping slightly from the mid-40s onward.[2]

Greasing skids, Pulling up Ladders

One important element of growth cycles is that they can lower or raise the barrier to copies. A single success in an industry makes competitors more fundable, and offers a playbook for new entrants. Sometimes, all a novel company achieves is a proof-of-concept: that there’s a buyer for a particular kind of product, even if the product itself is not that great. So follow-on entrants can improve the original version, pay closer attention to how high the S-curve goes, and achieve much better returns.

The Blackberry followed this arc: it basically created a market for an always-connected device built for people who always needed access to email. Which meant it created an expectation that any professional was available for a quick one-line email on an hour’s notice during their waking hours. And that made a market for a better-designed, more flexible device like the iPhone.

Facebook and Google made it possible for other companies to acquire a large audience, but charged a high price, and had durable scale and network effects that made a direct challenge difficult. Even while they made direct competitors tough—it’s hard to build a general search engine acquiring customers via AdWords, and doable but expensive to build a social network audience by advertising on social networks—they made building a search- or social-adjacent business easier. The combination of greasing the skids and pulling up the ladder means that big advertising platforms make it compelling to build complementary products: if there’s a set of Google searches that are poorly-served by the Internet’s existing content, Google is a viable channel for marketing a site that serves that demand; Facebook makes it so that any business that could benefit from hyper-targeted ads will get most of its benefit from Facebook. Amazon is designed so third-party sellers can make good money offering anything that Amazon shoppers look for but can’t find on Amazon.

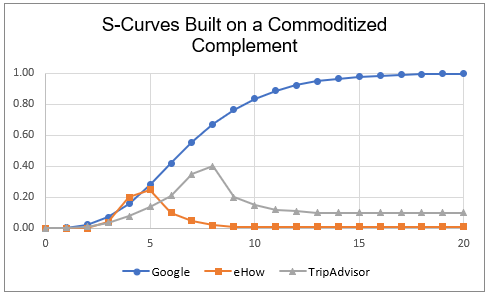

Big platforms build potential S-curves for other companies to ride. Google was an affordable sales channel, for paid and organic search. This has created numerous businesses, and enhanced others, but some companies either structured themselves around eternally cheap ads or built themselves around parts of the Google algorithm and layout that weren’t permanent. If Google’s traffic is cheap, and a business can resell it for more, that’s a profit opportunity—for them, but also for Google, which can cut out the middleman.

And in some cases, an incumbent manages to restructure a business, capture the highest-margin piece, and commoditize the company that helped make their business possible. Since failure has so many causes, it can’t be directly attributed to competition or commoditization, but they’re frequent culprits:

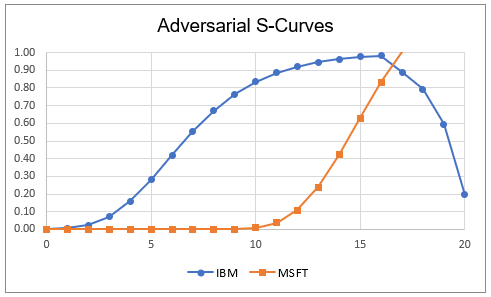

If every company is trying to optimize its resource consumption to maximize output, it’s going to grow until some constraint slows it down. The bigger the company, though, the more it reshapes the entire environment; Google made some businesses possible, and since those businesses could grow their audience at Google scale, it made them grow far faster. Platforms are naturally allergic to high-margin hypergrowth by their customers—if it’s scalable and profitable, it’s probably an arbitrage, and owning a platform means having an eventual monopoly on all arbitrages that platform enables. In IBM’s case, they helped make Microsoft ubiquitous, and Microsoft’s ubiquity helped materially erode IBM’s importance.

Bottom of the Curve

If you’re aiming for maximum success, why not pick the steepest S-curve you can find?

Why not, indeed?

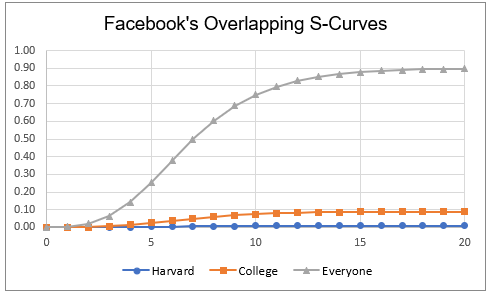

If Facebook had started by trying to dominate the world, rather than Harvard, they would have had a much slower growth path. Any random person who joined the site wouldn’t have a single friend—so they wouldn’t stick around long enough to receive their first friend request. By starting with an audience of a few thousand people, Facebook was able to reach network density fast. They expanded gradually, and at times with trepidation, to other Ivy schools, then to other colleges, then to high schools, then to everyone. They jumped from one S-curve to another:

This is a point Reid Hoffman makes in Blitzscaling: network effects are nice when a company grows, but they’re terrible when it’s subscale. When nobody used Airbnb, nobody had any reason to use Airbnb, and the founders had to hustle and growth-hack their way to viability, one city at a time. The Airbnb network effect had brief flashes of unsustainable usage, during a design conference and the 2008 Democratic National Convention, but the actual network effect took a long time to work. A network effects-driven growth strategy grows on its own once it gets rolling, but the beginning is more prosaic:

Marketplaces are so hard to get rolling that you should expect to take heroic measures at first. In Airbnb’s case, these consisted of going door to door in New York, recruiting new users and helping existing ones improve their listings.

One reading of the Airbnb story is that they converged on the right S-curve. Their first S-curve, renting three airbeds to attendees of a design conference, was too shallow. Market saturation was a few transactions away. The next S-curve, a global product, was too steep. But the New York S-curve was just the right slope to be achievable and worth trying. (And “New York” might be too broad: going door-to-door means picking out neighborhoods, since NYC’s 3.2m households represent too many doors for even a very energetic founder to knock on.) But success in New York let them shift to another S-curve, dominating quirky-but-affordable travel. And from there, they could advance to their current steeper but more rewarding S-curve.

The most successful companies make a habit of 1) surfing a rewarding S-curve, and 2) planning ahead so they can shift to the next one.

It’s the signature of every great company that, if it occurs to you to compete with them, you realize you’re a few years behind. Earlier this year, I looked into the secondary market for shares in private companies, and after lots of research and due diligence, realized that Carta had quietly gotten a five-year head start. The S-curve shift is a particularly valuable strategy, because it combines planning with misdirection. A company’s initial S-curve makes them look like a trivial product aiming for a small market—the kind of company that can easily be dismissed as unambitious. And the shift to a new curve diverts resources from other projects, so superficially it looks like an unambitious company that’s also slowing down.

One indication that a company is at the top of the curve is that its decisions are less existential but much harder. When a business finds a working growth strategy, scaling that growth is nontrivial, but ultimately involves optimizing for just one metric. When growth stalls, it involves endless complex tradeoffs. Facebook, for example, needs to grow users and to add engineers. Its users (on the core app, in the US) are right-of-center, and its engineering staff is left-of-center, so every decision with political implications is a choice that trades off between two critical metrics.

No one has composed a good corporate Siddhartha guiding CEOs through the process of the growth-to-maturity transition. And the biggest US tech companies seem to have an instinct for continuously scouting out newer and better S-curves, or at least diversifying from one huge curve into dozens of smaller ones that add up to a larger overall market. The usual way the transition works is that the founding CEO retires, or otherwise leaves the company. Switching from a startup to a growth company is rewarding, both financially and morally, but going from growth to stability is wrenching, even if the money’s still good.

It’s a necessary process, though. Since the industrial revolution, US growth has been eerily stable over long periods, but the nature of that growth has completely changed. Economic growth is one S-curve stacked on top of another, ad infinitum, and as the economy gets bigger and more complex, the law of large numbers gets stronger. Inside that fitted-exponential-hugging trendline is an endless series of stories of daring, ambition, hubris, and stagnation, all occurring at different timescales. For the most successful people and companies, success is a matter of identifying when the plot will get depressing, and switching stories before it does.

[1] Like a social network, a political movement has to start out obscure-but-very-cool; ideally it’s invite-only, and there’s no good way to request an invite. To grow, it has to manage the glide path from elite/exclusive to boring/ubiquitous.

[2] Older people often see their peak net worth growth a bit later, but that’s because of compounding capital, not pure wages. And while there are some investors who put up great numbers late in their careers, the usual rule of thumb is that late-life record net worth is achieved through a slowly declining growth rate on top of a continuously compounding base.

Elsewhere

Google: Benefits and Retention

Google has a new program to help employees pay student loans. This is a trivial cost for them on the surface, but illustrates one of the levers large companies pull to reduce employee defections: the more their benefits are comprehensive, and simplify employees' lives, the more logistically challenging it is to quit. Google looks great on a résumé, which is another way of saying that any college graduate vetted by Google is immediately a target for recruiters.

It’s basically the HR equivalent of Zoom’s strategy of leasing teleconferencing hardware to customers: they want to make leaving complicated and inconvenient enough that it’s not worth the effort.

Tail Risk on Trial

There are three broad schools of thought around how investors can avoid being caught in a market crash: they can time the market (which is hard, since, by definition, the average investor can’t do it); they can diversify into lower-risk assets or anticorrelated assets (which, with most such assets yielding close to zero, is challenging for other reasons), or they can use a tail-risk fund. The pitch for tail-risk funds is that they can structure a set of bets on a market crash, such that an investor who owns mostly equities is protected during a crisis, and can even buy more stocks at low valuations. But it’s a tough sell.

Normally, financial products get sold to institutions based on some kind of backtest. But for crisis insurance, the problem is that every crisis changes the way insurance gets priced. After 2008, many asset managers wanted to buy tail-risk hedges, and as a consequence, the price of tail risk insurance was inflated to ludicrous levels. The crash of 1987 made some options traders rich, but permanently raised the price of bets on extreme price moves; the trade worked, one time. In a sense, a tail-risk fund’s backtest consists of its founders' knowledge of market structure and derivatives, and their personality type; the risk/reward of the trade itself always has a sample size of 0 when the tail-risk plan is put in place, and 1 once its history is irrelevant.

A Theory of Policy Homogeneity

Robin Hanson asks why regulatory choices are correlated across nations. This is an important question, because it lends itself to very positive or negative answers. The positive answer is that we’re at the end of history: every country that’s sophisticated enough to create nuclear bombs, human clones, or prediction markets is also smart enough to regulate them in similar ways. Alternatively, elites could be conformist, and peer pressure emanating from New York, Davos, Basel, and Brussels could nudge everyone to fall in line.

In the latter model, a rise in nationalism has positive effects on the flow of ideas that partly mitigate its negative effects on the free flow of people and goods: if more countries adopt different ideas about what kinds of research are acceptable and what kinds could be banned, it’s a sort of implicit global federalism that allows the best regulatory regimes to demonstrate their benefits. The object-level effects very much depend on whether this results in more pharmaceutical trials or more nuclear proliferation, though.

Procurement

Anduril has been selected to help build the Advanced Battle Management System, a new software program for coordinating different parts of the Air Force and Space Force in combat.

Defense is an industry where the bull case on startups is that the incumbents are terrible (and the budgets are big—US defense spending was $686bn last year):

One unique aspect of Anduril is that while they are a defense contractor, they actually take on all the research and development (R&D) risk themselves, before selling to government. This is a significant shift in the way things have “always been done” because the U.S. government –taxpayers — take on all the funding and R&D risk in the form of “cost-plus” contracting, where contractors are paid a guaranteed profit, regardless of cost. With Anduril, the U.S. government not only saves this money but diversifies its portfolio of the best defense technologies.

The bear case on defense tech is that it’s the worst of enterprise software: selling to a buyer who isn’t the end user, and who is more sensitive to upfront specifications than to whether the product itself is useful. A shift to new vendors like Anduril implies that the sales-over-product and specs-over-outcomes approach is eroding.

Density Redistribution

One model of cities, which I’ve written about before, is that their density and high prices compound the network effects that cause those prices in the first place. Covid has redistributed some of the beneficiaries of those effects to less dense places; it’s hard to make friends via Zoom, but relatively easier to maintain them. Japan is now trying to accelerate this, by offering a $9,000/worker subsidy to people who relocate from Tokyo. The ostensible goal is to encourage tech companies in rural areas, but that’s a hard sell: without a dense cluster of similar companies, the Internet rather than the real world will be the default place for these workers to network. And with costs outside Tokyo already lower, the extra money won’t turn into consumption, either. So this policy ends up sounding like a lot of Japan’s fiscal policy since the start of their Lost Decade: the government deficit-spends, which puts money in people’s pockets, but those people end up saving the money instead of spending it. The net result is a scarier deficit that doesn’t lead to inflation or growth.

Crisis Hormesis

Bloomberg profiles Andreas Lehnert, the Fed’s “disaster junkie.” He says the Fed has contingency plans for all sorts of unlikely disasters, and was able to dust one of quickly in the early days of Covid, and put it into action. This sensitivity to risk came about in an unhappy way, though. In 2005, Lehnert reported:

“Institutions with large amounts of mortgage credit risk on their portfolios are well-positioned to handle severe losses,” Lehnert said then. “Neither borrowers nor lenders appear particularly shaky. Indeed, the evidence points in the opposite direction: Borrowers have large equity cushions, interest-only mortgages are not an especially sinister development, and financial institutions are quite healthy.”

Some institutions respond to crises by getting good at crisis-management, others in a more destructive way. It’s unclear exactly what the dividing line is; since the Fed did well in this crisis, you can tell a story about how long employee tenure and a tolerance for understandable mistakes helps them build knowledge over time. On the other hand, if the economy were doing worse right now, a profile of the same economist might focus on the fact that he dismissed the risk of a mortgage crisis and didn’t get fired.

Careers often follow a Joseph Campbell-style Hero’s Journey, and the most effective people seem to be the ones who get through their career nadir early enough that the damage they’re responsible for is limited but the lessons are memorable.

The Other Derivatives Narrative

There are two classic genres of derivatives disaster stories: in one, a sophisticated institutional investor makes a large bet that, for very various academically interesting reasons, blows up on them in spectacular fashion. The other is that a ruthless financial institution sells trades to investors who don’t quite understand them, whether those investors are individuals or smaller, less sophisticated institutions. SocGen is going through a third, less well-known story ($, FT): they built an equity derivatives empire, selling risk permutations to everyday investors. Because they were slicing up risks and selling only the most attractive bits, they ended up warehousing some odds and ends, and those odds and ends did poorly.

(Other sources give more details: due to the quirks of retail demand and hedging ability, SocGen and other European banks ended up owning large positions in equity dividend futures. These generally track the broader market, but a short/sharp recession can blow up the trade in hard-to-hedge ways.)

One comment on the FT article makes a useful point about potentially toxic derivatives products:

Back-testing optimisation: products were sold on the basis of their backtest (almost) exclusively. Therefore, the basket of stocks/indices was carefully selected and optimised to look good. Stocks were swapped around to find the best-looking possible combination (e.g. suitable stock trends), which essentially also resulted in the biggest gap between historical parameters (e.g. realised volatility and correlation) and implied ones (implied volatility, correlation, dividend yield). Basically, historical parameters are what is shown in the backtest, implied parameters are the cost of hedging.

In other words, part of the structured products model was to toss many coins many times in a row, and then sell Lucky Nickels at a premium.

Byrne Hobart

Byrne Hobart