Understanding Coinbase

Is Coinbase an exchange, a broker, a hard-money bank, or a for-profit branch of a religion?

In one sense, Coinbase is an exchange: it's a venue where people buy and sell cryptocurrencies. One of the calls-to-action on their site is "View Exchange," and if you click you get this hypnotic real-time look at the Bitcoin market.

In another sense, Coinbase is a broker. It's a custodian for assets, including cash and more speculative assets. Like many such custodians, it also prefers that you use a cash-like asset with a little more pizazz—for a broker, that would be a money-market fund; for Coinbase, it might be USD Coin, a blockchain-based dollar substitute. Coinbase, like large broker-dealers, expedites transactions for customers and sometimes takes the other side in order to provide them with liquidity.

You might model Coinbase as a hard-money bank; most crypto assets try to be currency in some sense. While this produces lots of arguments, the net result of those debates is the realization that it's surprisingly hard to define a currency. All the obvious criteria exist on a continuum, which is why companies can refer to their equity as "currency for acquisitions," while certain currencies themselves are imperfect means of exchange. Brian Armstrong, Coinbase's co-founder and CEO, lived in Argentina during a time that one observer called "the world’s most annoying economic crisis," when a coin shortage made every cash transaction an exercise in mental math and a parodic form of Gresham's Law. If cryptocurrencies are currency-like enough to count, then Coinbase is mostly a bank that keeps 100% of deposits on hand in cash at all times, and that charges fees for currency exchange and other services.

Or, Coinbase might be a for-profit appendage to a religious phenomenon. Bitcoin, after all, has a departed founder, a unique eschatology, adherents with weird diets, and a sense that it's being persecuted by worldly authorities. (Edit: Joe Weisenthal made this point earlier and in more detail. Also, see this paper by Tobias Huber and Didier Sornette.) Religious tourism and faith-related media are both big businesses. Why not a religious financial institution?

Coinbase is a bit of all of the above, and one thing that's especially remarkable about their S-1 is that they bend over backwards to walk through all the bear cases on their company and the assets it enables access to. Coinbase knows that their fate is tied to cryptocurrencies, and that convincing investors they're a viable business means convincing them that crypto is going to last.

The Risks

Coinbase was founded in 2012 by software developer Brian Armstrong, who remains its CEO, and currency trader Fred Ehrsam, who left in 2017 and later founded Paradigm, which invests in cryptocurrencies and adjacent businesses. Coinbase's original pitch was that it was "the easiest way to get started with Bitcoin," which remains a core part of the story today. They weren't the first company to enable Bitcoin purchases (localbitcoins launched a few months before, and there were over-the-counter transactions before that). And there were exchanges like Mt. Gox that allowed Bitcoin trading. But Coinbase was easier, and, ultimately, safer than the alternatives. (Many of their erstwhile competitors operated on the implicit assumption that because there were no laws referencing Bitcoin, anything involving Bitcoin was probably basically legal. There are, of course, plenty of laws referencing dollars, who can send dollars to whom, and under what circumstances—competitors who disregarded this tended to run into trouble with their banks, the government, or both.)

Bitcoin is complicated, and Coinbase built two separate UI layers. One, the obvious one, was between the user and the Bitcoin protocol. Sign up, enter banking details, and you can convert Bitcoin into fiat. The other layer they built was between the Bitcoin ecosystem and the financial and regulatory establishment, which started out largely thinking Bitcoin was either ridiculous or criminal.

In some ways, Coinbase has been preparing for an S-1 all along. Since it was founded, the company has gotten lots of experience explaining itself to skeptical regulators and financial partners. At a normal company, the "risk factors" section of the S-1 requires some brainstorming; for Coinbase, they can just go back through their last nine years of meeting notes and pull out every tough question they've ever gotten.

The risk factors section is also recursive: Coinbase's economics are tied to the success of crypto, a point they repeatedly make throughout their prospectus. But this means that crypto itself is a risk factor: if the company executes its strategy perfectly, and cryptocurrencies are banned in the US tomorrow, it's a zero. This more or less requires them to steelman the case against cryptocurrencies—that they facilitate illegal behavior, that they're worthless, that a technical flaw in a protocol could ruin them, that network congestion and high transaction costs make them a poor currency, etc.

Some of the risks are positively futuristic: they compete against decentralized exchange-like platforms, where market-makers trade directly with users. In a way, this is like any other software company that nominally competes against open-source clones; Adobe users could switch to Gimp, and Microsoft could hypothetically lose revenue due to OpenOffice. But the decentralized entities Coinbase competes against can have a life of their own even if they're not updated or maintained; Coinbase, a company with over a thousand employees, competes against incorporeal techno-economic zombies.

They don't address all of these concerns; the point of the "risk factors" section is to enumerate things that could go wrong, not to tell investors that they'll go right; the rest of the S-1 is Coinbase's chance to tell the world what their business looks like when the crypto charts are all up and to the right.

Upside

Coinbase makes most of its money from transaction fees, with small but growing revenue from custody, staking, and helping new crypto projects acquire users. It reports revenue from trading directly with customers, a service it offers both to help with small transactions and to provide liquidity during platform downtime. This last piece is 11% of reported revenue, but economically it's a lot closer to their gross trading number.

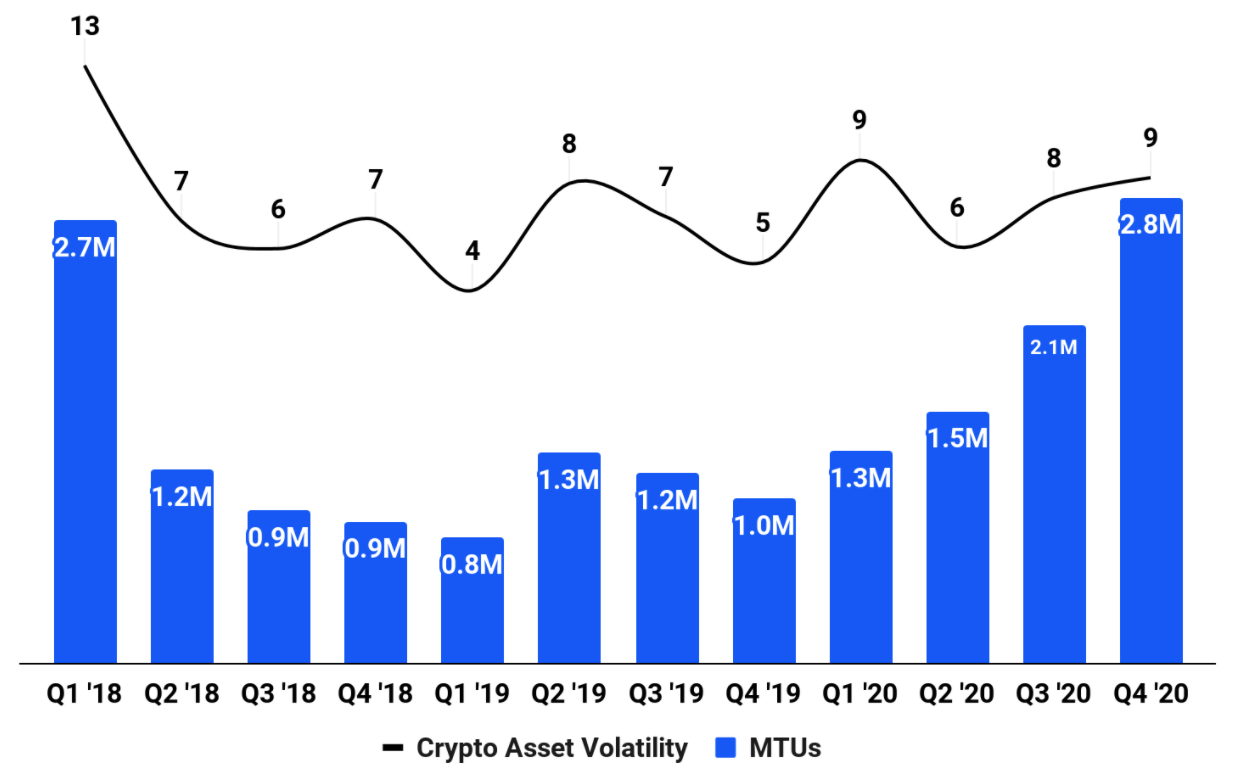

Their transaction revenue is highly sensitive to crypto volatility. This chart from the S-1 illustrates it, benchmarking their monthly transacting users against a measure of how much cryptocurrency prices are changing:

It took almost three years for Coinbase to exceed the user activity level from the last peak.

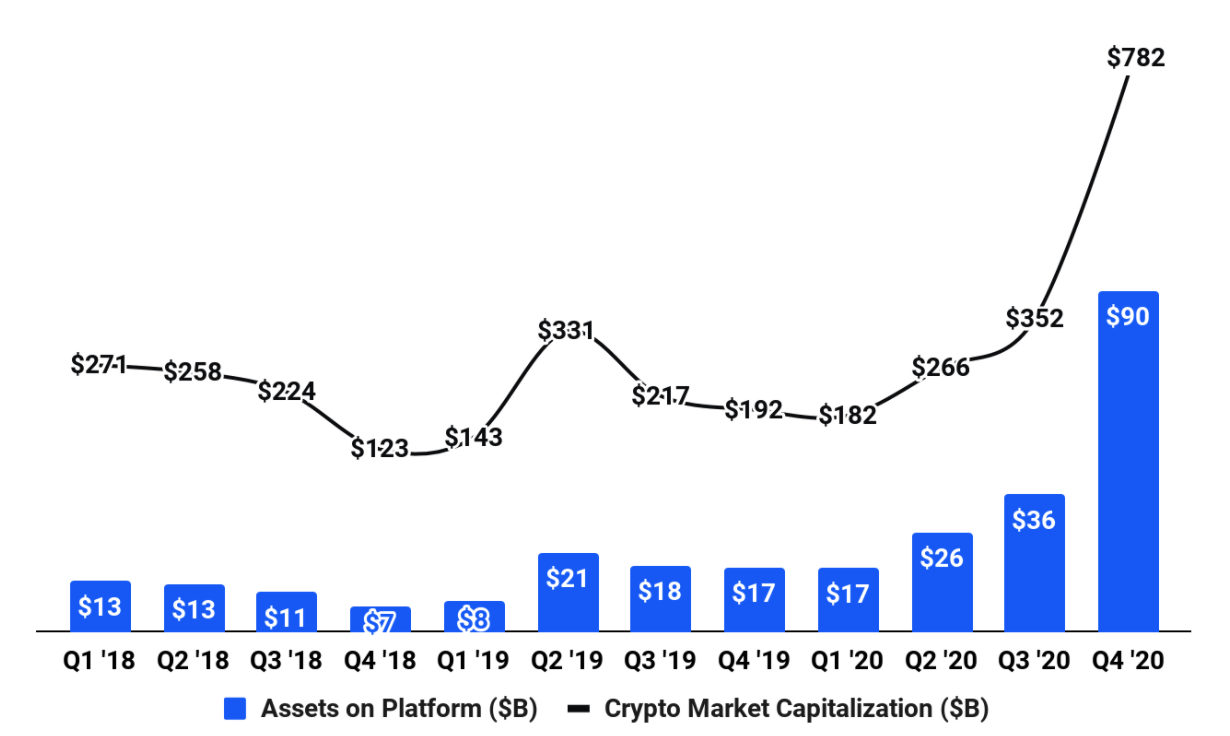

A more promising trend is the next chart:

Coinbase has been growing as crypto has gotten more popular, but it's been growing its share of crypto, too, from 4.5% at the end of 2018 to 11.1% today. While this is impressive, it also means that Coinbase's custody economics will have to change as it grows; in 2020, the company earned $18.6m in custodial fee revenue in 2020, and their average share of all crypto asset custody was 10.6% for the year. So at current custody economics, the maximum size of that revenue stream with 100% market share is $174m. Of course, there's upside to that number if the value of the crypto market rises. But there are more direct ways to bet on that, using, for example, Coinbase.

Their trading revenue trends are a mixture of incredibly positive in the short term and more questionable over time. Coinbase captures about 0.67% of the value of trades on its platform as revenue; in Q4, that meant $87bn of trades produced $497m in transaction revenue. By contrast, Nasdaq Inc. produced net market services revenue of $1.1bn in 2020, on around $300bn per day in cash equity trading volume.

Coinbase is capturing a very high share of the value that's transacted on its platform. That number has been declining over time, as more of their trades are done by institutions. A common lifecycle for financial companies that pioneer new asset classes goes like this:

- At first, they're the dominant player, and can charge high fees.

- Competition arrives! It looks like they'll lose market share, but, while they do, and while fees drop in percentage terms, the market expands so much faster than they come out ahead.

- The market matures. Fees keep dropping, but growth slows down.

Phase Two can last a very, very long time. In equities, options, foreign exchange, corporate bonds, and more, the big money in commissions was mostly made at times when commissions were declining. So Coinbase's gradually shrinking rate of revenue capture is a feature, not a bug; it indicates that they were early to a profitable market, and their size shows that if there are economies of scale in trading crypto as such, they'll be able to realize them. The risk is that they're a victim of their own success: that they do such a good job of making the investment case for crypto, and the legal case for it, that it becomes just another asset class, and multi-product firms outcompete them by gathering more assets.1

Coinbase does have some plans for how to cope with Phase Three. They're already helping to expedite staking, DeFi-based lending, and other products that generate continuous revenue from crypto balances. That's a good way to gather assets and acquire longer-tail revenue sources. It's a very specific bet on the crypto economy: that Bitcoin won't just be a store of value, but a template for an entirely new way of thinking about money, and about financial intermediaries in general. Given how crypto has performed so far this year, Coinbase's Q1 numbers will probably be quite impressive. But the business is going public in the midst of an evolution, from a vehicle for speculation to a bridge between old and new financial models.

Competition from more lightly-regulated companies makes Coinbase a complicated regulatory bet, close to a bull call spread on crypto regulation. More of it is good, especially if "more" means loosely-controlled jurisdictions getting compatible with US standards. Too much, and parts of their business are banned. That's roughly the direction regulations seem to be headed, at least in the US: away from banning, towards regulating and standardizing. Coinbase, which has been building its relationships with the relevant authorities for years, is in a good position to guide that standardization (and to operate as if new regulations are already in place).

While regulation is mostly an upside catalyst to Coinbase, that status embeds its own problems. Coinbase is a sort of bridge between the more religious world of crypto-maximalism and the secular world of traditional finance. Coinbase only knows they're doing their job exactly right when the number of people calling them fiat-loving sellouts is precisely balanced by the number of people making variants of this argument to them. Achieving the right balance between ideological purists (who are more likely to build something new) and mercenaries (who are more likely to put together a version of it that a) more than a handful of people will use, and b) that will turn a profit) is a challenge that many tech companies have to navigate. A platform for free speech absolutists will eventually have to deal with unpopular, or illegal, speech; an open-ended e-commerce platform has to cope with the kinds of things people want to buy and sell; a video sharing platform will eventually draw the line at certain kinds of videos. And a company like Coinbase has to navigate the fact that what is "revolutionary" to a crypto fan is somewhere between "destabilizing" and "an existential threat" to other parts of the financial system—including the parts that are charged with keeping the system stable.

One thing that stands out about recent IPOs, excluding companies that go public via SPAC, is just how mature they are. Coinbase has 43 million customers, and cleared over a billion dollars in revenue last year. E*Trade went public in 1996; their S-1 discloses some 65,000 customers. But E*Trade was a relatively small departure; electronic trading in some form predated it, and the business-defining moment for the company was a Super Bowl ad. Coinbase is going public at a much more mature stage, but it's also going public as a transitional company—one that's using revenue from speculative trading to build a decentralized economy, and one that's threading a narrow gap between fighting with unregulated competitors and getting its longer-term upside regulated out of existence.

Further reading: Kings of Crypto tells the Coinbase story from founding through about a year ago. The S-1 is good reading. Brian Armstrong has done recent interviews with Tyler Cowen and with a more adversarial Noah Smith ($). This piece from Front Month is also a good overview of its economics relative to traditional financial exchanges.

Disclosure: I own Bitcoin, and previously worked at a company that sold to Coinbase, although I left before my options vested. (Whoops.)

Elsewhere

Security

There have been many bull markets over the last twelve months—in SPACs, large-cap tech, commodities, and housing. There's also a bull market in security vulnerabilities. While the SolarWinds breach, the recent Exchange hack, and yesterday's security camera vulnerabilities are the most headline-worthy, the general pace of serious security issues is accelerating:

Google’s 0-day tracker spreadsheet has so far flagged 12 in-the-wild 0day attacks in 2021 (there were 24 total last year) and I know they’re missing at least two — the Sonicwall firewall attacks and the Accellion incident that’s also causing a world of hurt downstream.

Let that sink in: we’re not yet done with Q1 and defenders are in scramble mode to deal with 14 zero-day attacks across a range of platforms, products and operating systems.

News about breaches is a leading indicator of their consequences, but it's also a lagging indicator of attackers' capabilities: the news hits when they get caught, not when they succeed, which means the worst security-related headlines will arrive after the worst attacks are over. This makes it very complicated to call peaks and troughs in the security business cycle.

Different Abstractions

This is a very readable overview of post-Keynesian theory from @tragicbios. Importantly for investors:

Financial markets love [post-Keynesianism], because it does a good job explaining how the economy runs, which is helpful if your paycheck depends on understanding the economy. It gives good causal heuristics for understanding the impact of financial flows on production, and on the economy at large.

The piece correctly points out that classical and neoclassical economics rely on invisible abstractions—consumer preferences, utility—to build idealized assumptions about human behavior. But that problem is unavoidable; "demand" and "investment" are also abstractions, which hide important truths about the relative desirability of specific instances of those aggregates. Repairing potholes in a thriving city and building a bridge from nowhere to nowhere both show up as demand-stimulating investment, but their long-term payoffs are very different. Post-Keynesianism does give excellent guidance on one of the fundamental facts about the economy, that most of us are trying to pay the bills and that economic slowdowns have magnified effects when checks start to bounce. But the models remain imperfect.

It's especially interesting to think about companies embodying either a post-Keynesian or neoclassical approach. The post-Keynesians correctly point out that we don't smoothly move along supply and demand curves; shifts in supply and demand don't generally cause Apple to continuously adjust the price of an iPhone until the market clears. But some of the most profitable tech companies do switch pricing systems from sticky administered prices to market-based ones; selling ads through a real-time auction is much more lucrative than selling a big block of TV ad time during the upfronts. And while “utility functions” are theoretically invisible, they are a lot more visible to companies that can see exactly what people look at, what tradeoffs they make when they fill a shopping cart, what products they search for, and what features they fixate on. So there's some economic upside from building neoclassical systems that outcompete a stodgier, more post-Keynesian world. Elegant abstract systems are less realistic than the ones that are built off of empirical observations, but their elegance also means that they’re more powerful when they’re right.

Facebook Futurism

Facebook Reality Labs has a piece on the future of augmented reality and always-on computing. FB has been paying attention to this market for a long time, but changes in the ad business give it a new sense of urgency. From a privacy-conscious advertiser's perspective, one of the convenient things about augmented reality is that it gives a huge volume of contextual information about where someone is and what they're interested in. And it's all first-party data. From a technological and social perspective, augmented reality is interesting because it's the clear extrapolation of long-term tech trends—your screen gets smaller and closer to your eyeballs over time, while the latency between thinking of something and interacting with a computer to get that something goes down. But from a business perspective, it's a notable development because it will give Facebook exclusive access to a stream of real-time data that, while mostly noise, will contain useful hints for ad targeting (in addition to representing lots of exclusive inventory).

SPAC Apathy

Shareholder votes are typically a formality, and occasionally rise to the level of a political campaign. As in politics generally, a small set of people have very strong interests in a specific outcome, a larger fraction have default voting behaviors that don't change much, and a small set of low-interest, low-information voters get most of the persuasive attention. Unfortunately for SPACs, 1) shareholder votes generally don't get wall-to-wall media coverage, especially if they're over procedural issues like extending the SPAC's deadline to do a deal, 2) retail investors are less likely to vote, and 3) some corporate actions require a minimum number of affirmative votes, rather than being based on a simple majority of votes cast. As a result, some SPACs are having trouble closing deals because they can't get the votes ($, FT). Investing in a pre-deal SPAC at its net asset value is a sort of lazy call option; it's a chance to either get the cash back or get a stake in a business. But selecting for laziness turns out to have downsides.

Of course, in a scenario where the legal risk of crypto drops to zero and it's in everyone's portfolio, the value of crypto is much higher—maybe in that world, Coinbase faces lots of competition from Robinhood, Goldman, and every other financial institution, but also starts offering the same range of financial products those companies do, because every sufficiently early Coinbase customer is now a high net-worth individual who can support a lucrative wealth management practice. ↩