At the limit, commerce and communications are the same thing. Prices are very information dense, so they’re the first bidder for incremental reach or lower latency. There’s abundant historical evidence for this: some of the oldest written documents we have outline commercial transactions, the Rothschilds used carrier pigeons to get information (though, contra legend, not at Waterloo), the first transcontinental telegraph was built to provide faster FX quotes (that’s why GBP/USD is called “the cable”), and the information that travels farthest fastest today is the current bid/ask spread on futures contracts.[1]

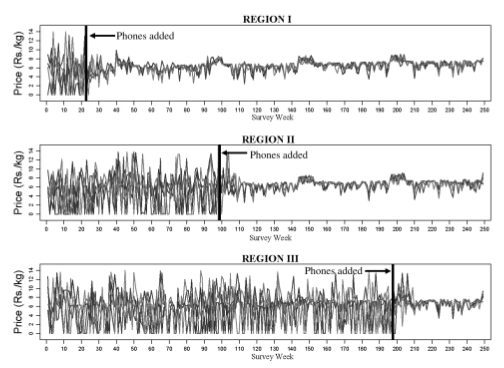

Capital markets are usually the first use case for new kinds of low-latency communications. The most informative bits need to arrive the fastest. But retail is the strongest use case for new kinds of high-breadth communications. One of the most striking examples of this comes from the introduction of mobile phones to fishing villages in Kerala. Almost instantly, price volatility disappeared.

In the last few weeks, there have been two stories that highlight broad communications tools as a tool for driving commerce.

Facebook, Jio, and Payments

Reliance Jio, an Indian mobile carrier with 386m subscribers, has raised money This year from Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, the Abu Dhabi Investment Authority, and TPG. These rounds, announced roughly weekly, have totalled over $13bn.

When Facebook did their deal in April, I speculated that Facebook wanted to subsidize the lowest-cost Indian data provider to push down prices and indirectly subsidize Facebook usage.

Clearly, that was wrong. Facebook’s explanation is worth quoting:

Our goal is to enable new opportunities for businesses of all sizes, but especially for the more than 60 million small businesses across India. They account for the majority of jobs in the country… One focus of our collaboration with Jio will be creating new ways for people and businesses to operate more effectively in the growing digital economy. For instance, by bringing together JioMart, Jio’s small business initiative, with the power of WhatsApp, we can enable people to connect with businesses, shop and ultimately purchase products in a seamless mobile experience.

Investing in India is tricky, because the government is intermittently aggressively protectionist, and sometimes launches sweeping crackdowns on previously-tolerated economic activity. One good way to stay on the right side of India’s regulatory apparatus is to invest with Reliance. (The firm is powerful enough to get an exposé banned, for example.) But another way is to make an investment that aligns with the state’s priorities.

When Facebook says that small business jobs are most of the jobs in the country, they’re omitting an important detail: India’s informal sector employs four fifths of the workforce. The government is trying to track these workers better, so there’s a regulatory tailwind for any company that can move transactions from paper to digital.

Facebook has payment plans elsewhere, too. Yesterday, they launched a WhatsApp-based payment product in Brazil. Brazil’s off-the-books economy is also sizable, albeit smaller than India’s, but Brazil has still-challenging pension obligations which makes it more important for the country to monitor and tax economic activity.

Communication, identity, and payments are all fundamentally tied together. Any payment system that doesn’t involve hard currency has some form of identity verification. Phone and messaging companies have an incentive to do a moderate amount of identity verification in the course of their business; someone who signs up for WhatsApp and spams a thousand people but never gets a reply is probably a bad actor, whereas someone who signs up and starts a series of back-and-forth conversations is more likely to be real. The messaging product is its own proof-of-work. Looking at WhatsApp today, you could imagine that this was the plan all along: bootstrap a universal identity system and communications network, and use to create smartphone-based payment rails that skip legacy payment systems and enable more transactions.

That was not, of course, the original plan. But it’s halfway between an opportunity and a necessity for Facebook. Since WhatsApp is end-to-end encrypted, it can easily support wholesale commerce, and coordinate engaging in such commerce without reporting it for tax purposes. By making payments a feature of the app, Facebook switches from a potential abettor of tax evasion to a part-time tax-collector.

Snapchat and Shopping

Payments don’t just tie into messaging in environments where existing payment infrastructure is weak. It also works when messaging apps have so seamlessly replaced in-person communication that they can recreate real-world socialization remotely. Last week at their Snap Summit conference, Snap announced minis, apps that run inside Snapchat and enable group experiences like buying movie tickets and coordinating schedules.

Minis are essentially a Snapchat-specific implementation of WeChat’s Mini Programs, which (via Turner Novak’s excellent summary of the Snap summit) handled $115bn in GMV in 2019. For any kind of purchase that could be a shared shopping experience—movies, sure, but also clothes, games, and travel—Snap can create a Mini to handle the interaction.

And this is especially valuable because the prompt to start the purchase is mixed in with other social communications. Snap Minis let friends spam each other, and the shopping process has social proof upfront.

This is not a way to tap into a new, underbanked demographic. It is, given Snap’s 75% market share in 18- to 34-year-olds, a way to reinvent the mall.

Media and Message

The unsolved problem in mixing messaging and commerce is a good problem to have: how do messaging platforms deal with the spam problem? For a messaging app, the viral loop of notification-reply-notification is their most cherished asset. When messaging platforms peak, their daily- to weekly-active-user ratio takes a long time to fall—but interactions per user drop fast. Any time an app goes from being opened every hour to being opened once or twice a day, it’s stopped being a messaging app and has turned into an email product with a subpar UI. This makes it risky to bombard users with commercial messages, even if these messages are technically from their friends

Right now, Facebook and Snap are at opposite ends of the spectrum: Facebook’s payments products are for harvesting demand, and Snap’s are for creating it. But in the long run, they should converge: Snap will want to capture a bigger piece of the economics it generates (not today, but some day), while Facebook will have a hard time resisting the integration opportunities. If someone uses Whatsapp to make a purchase, it would be crazy not to use that purchase data to target ads on Instagram and Facebook. Facebook is already moving down the funnel in its traditional business through shops, and payments can meet halfway.

This fits in with the long-term visions of both companies. Snap wants to be a lens on the real world; Facebook wants to be an invisible, forgettable, indispensable utility. (“Maybe electricity was cool when it first came out, but pretty quickly people stopped talking about it because it’s not the new thing, the real question you want to track at that point is are fewer people turning on their lights because it’s less cool?”) Both views are ultimately in conflict, because they each require users to filter their view of the world through exactly one company’s products. And they both start by converting the breadth of messaging platforms into an ad hoc payments system.

[1] A friend of mine built one of the early microwave connections for high-frequency trading, and can now accurately claim that Salma Hayek played him in a movie.

Elsewhere

Levered Pensions

Underfunded public pensions have been a Diff theme for the last few months. The short story: pensions have unrealistic return expectations, and are under-funded even relative to those. At some point, they’ll run out of money and require some combination of higher taxes, lower payouts, or a bailout. The first two create a slow-motion run on the bank effect: if California’s taxes today are high to cover pension underfunding for the last two decades, workers have an incentive to work elsewhere. This shrinks the state’s tax base and forces taxes higher.

Pensions have tried to solve this problem through the time-tested approach of buying riskier assets, like private equity. Now, CalPERS plans to layer debt on top of debt by borrowing $80bn (or about 20% of its assets) to double down on these investments.

When pensions are underfunded, and their sponsor lacks the political will to admit it, their natural strategy is to make Martingale bets: if they lose, double-down and make it back. The classic Martingale payoff is a series of small profits followed by a catastrophic drawdown to zero.

To be fair to CalPERS, they have made the responsible decision to buy longer-dated treasury bonds. The main macro risk pensions take is that they’re massively short duration: their liabilities are fixed and in the distant future, while their risk assets' prices tend to move inversely to interest rates most of the time. By buying long-term treasuries, they’re partially hedging this risk out—but unsustainably. A pension fund that’s 71% funded at a 7% expected return can’t justify putting much of its assets into 30-year treasuries yielding 1.5%—but the fundamental reason for that is that a portfolio whose mandate is to deliver low-risk long-term yields should not be promising returns 550 basis points above long-term interest rates. (For comparison, in the year 2000 most public pensions were in pretty good shape, and had expected returns of 8% or so—which was about 200 basis points above comparable treasuries.)

Bankrupt Stocks: Not a Great Bet

Verdad crunches the numbers and finds that investing in the equity of companies whose bonds trade at a discount to face value is a terrible strategy. It is, in fact, one of the worst strategies I’ve seen in any published research that omits transaction costs: buying shares of companies whose bonds trade at 20 cents on the dollar or less has -94% annualized returns. (Transaction costs will mitigate most of the edge from shorting these, as the cost to borrow these stocks can be quite high. But the retail investors speculating in shares of bankrupt companies are generally not earning the borrow fee when they do so.)

Chip Wars

Steve Blank speculates that China will impose retaliatory sanctions on Taiwan Semi, which would certainly represent an interesting turn of events given TSMC’s planned US investments (covered in The Diff here and here).

Blank suggests that China won’t invade Taiwan, but might launch missiles(!) at Taiwanese foundries. This is a bit extreme, but sanctions and political pressure from China are likely. There’s an extension of the Golden Arches Theory of Conflict Prevention which holds that close economic ties between countries preclude military conflict. This was the argument for what became the EU: if enough of Germany’s coal was exported to France and enough of France’s steel was exported to Germany, neither country could afford a war. But a corollary to that theory is that the marginal cost of total war compared to limited war is lower: all-out conflict is unpopular because it leads to material deprivation, but if material deprivation is going to happen anyway, there’s an incentive to get things over with. Taiwan’s anomalous position—essential to China’s economy but nominally a rebellious province, but effectively guaranteed by the US—limits many of the bad outcomes close to the middle of the bell curve. But the tails of that distribution are fat and hard to model.

Elsewhere in US/China news: the US has adjusted sanctions after realizing that broad rules against working with Huawei prevented American companies from participating in 5G standards committees, which gave Huawei a monopoly on setting those standards.

The Fame Market

I once called Cameo the “dollar store for used fame.” They’re moving upmarket, and now sell Zoom calls with celebrities for $1,000 to $15,000. It’s an interesting way to disaggregate the market in fame. Normally, a famous person is an input to a bundle of mass-market products—a movie, a show, a book, etc. But the hard-to-model economics of Hollywood make it unclear who’s underpriced. For the top tier of famous people, the scale advantage of a big media production prevails over the pricing power of a one-on-one encounter, but there’s a long tail of semi-famous, micro-famous, or formerly-famous celebrities who can’t carry a feature film but can carry on a ten-minute video chat.

Inflation and Missing Prices

Covid-19’s economic impact has registered as deflationary, but that’s in part an artifact of using old purchase baskets: the goods people buy more of are rising in price, while the goods we’ve stopped buying are cheaper. Also notable: “[T]he share of products with missing prices in the US CPI rose from 14% in April 2019 to 34% in April 2020.” This out-of-stock issue is partially caused by online retailers who are reluctant to raise prices in response to supply shocks, demand shocks, or pretty much anything. As I noted in May:

Since retailers are very reluctant to raise prices, the visible effect will be deflationary: for products that were overproduced, retailers will want to get rid of them; for the ones that were underproduced, they’ll just show up as out-of-stock. Whether you treat that as inflationary or deflationary depends on whether you treat out-of-stock as a null entry or infinity.